Started financial crime countermeasure solution “AI Zero Fraud” LAC

LAC has developed AI detection technology for bank accounts that are fraudulently used by the Financial Crime Control Center (FC3) operated by LAC, and has started providing services by incorporating it into the financial crime countermeasure solution “AI Zero Fraud”. do. Through this, the company plans to expand its business in earnest to expand the use of financial crime countermeasure solutions.

In recent years, the number of financial institutions actively promoting the opening of online accounts has increased in order to improve convenience for customers. On the other hand, there is growing concern over the act of opening fraudulent bank accounts for criminal purposes.

AI detection technology announced this time detects and discovers fraudulent accounts from which criminals steal funds, and was developed with the cooperation of a major regional bank.

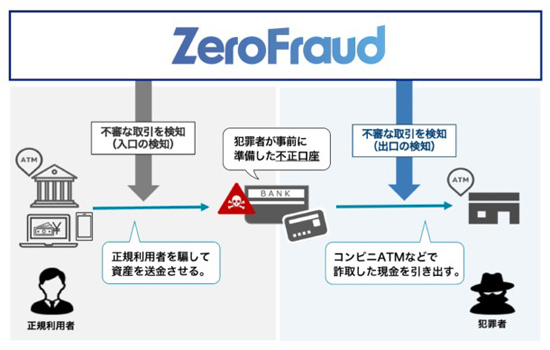

If transactions such as fraudulent remittances are the “entrance” for criminals to steal funds, then fraudulent accounts that serve as remittance recipients and used for cash withdrawals can be said to be the “exit.”

The entrance and the exit are two sides of the same coin. If it is possible to determine that the remittance destination of a fraudulent transaction is a fraudulent account, it will be possible to more effectively detect and deter fraudulent remittances and special frauds.