NTT to establish new financial company in July

NTT’s financial results for April to December 2025 showed increases in both revenue and profit. Operating revenue was 10.421 trillion yen (an increase of 3,713 billion yen from the previous year), and operating profit was 1.4571 trillion yen (an increase of 57.9 billion yen from the previous year). Both revenue and profit increased. Meanwhile, the full-year forecast has been revised downward to reflect NTT docomo’s acceleration of measures to strengthen its customer base for future growth.

Operating revenue increased due to the expansion of corporate business at group companies and increased revenue from the conversion of data centers into REITs. Operating profit increased due to increased profit from the expansion of corporate business at group companies and the conversion of data centers into REITs, despite cost investments related to measures to strengthen NTT docomo’s customer base and improve mobile network quality.

As of May 2025, the company’s full-year forecast was for operating revenue of 14.19 trillion yen and operating profit of 1.77 trillion yen, but has revised it downward to 14.164 trillion yen, a decrease of 26 billion yen, and operating profit of 1.66 trillion yen, a decrease of 110 billion yen.

President Shimada Akira said, “At docomo, we expect to spend more than expected on strengthening our customer base due to the intensifying and prolonged competitive environment. We will continue to steadily strengthen our customer base and improve network quality as important measures for future growth. We will work to recover our performance by growing our smart life business, centered on finance, and our corporate business, and by reducing costs through a fundamental review of our organization and business processes.”

President Shimada indicated his intention to establish a new company for the NTT Group’s financial business by July. The company plans to handle all financial services offered by NTT docomo itself, including financial companies acquired through M&A, as well as d Card and d Payment.

President Shimada cited the Financial Services Agency’s response as the reason for establishing the new company.

“We need to clarify governance in relation to financial administration. Our supervisory agency has traditionally been the Ministry of Internal Affairs and Communications, but financial services fall under the scope of the Financial Services Agency, so we want to firmly establish a system that can handle the FSA’s response,” he said.

He also mentioned the mass production of photonics-electronics convergence devices. The company announced that it will commercialize photonics-electronics convergence devices by fiscal year 2026.

Currently, NTT Innovative Devices is leading the effort to promote automation of assembly, mounting, and inspection processes, increasing production numbers per line, and expanding production lines in response to demand.

“These efforts will enable monthly production of up to 30,000 units. We would like to actively develop demand from high-speed scalers and cloud providers,” President Shimada said.

NTT docomo Continues Network Resilience Enhancement

NTT docomo’s April-December 2025 financial results show increased revenue but decreased profits. Operating revenue was 4.6597 trillion yen (an increase of 92.4 billion yen from the previous year), and operating profit was 745.4 billion yen (a decrease of 88.5 billion yen from the previous year).

President Yoshiaki Maeda commented, “We are in a difficult financial situation. This is due to the necessary measures being taken to secure future growth and the necessary costs being invested.”

The company is prioritizing strengthening its customer base, which serves as the foundation for medium- to long-term growth. Positioning fiscal 2025 as a year of transformation for growth, the company is working to strengthen its customer base by strengthening sales promotion and reinforcing its network.

In terms of strengthening sales promotion, in addition to improving the appeal of “docomo MAX,” the company is promoting cross-use with smart life services to shift to a more engaged customer base.

docomo MAX is on track to achieve its annual target of 3 million subscriptions, and ARPU is also steadily increasing year-on-year.

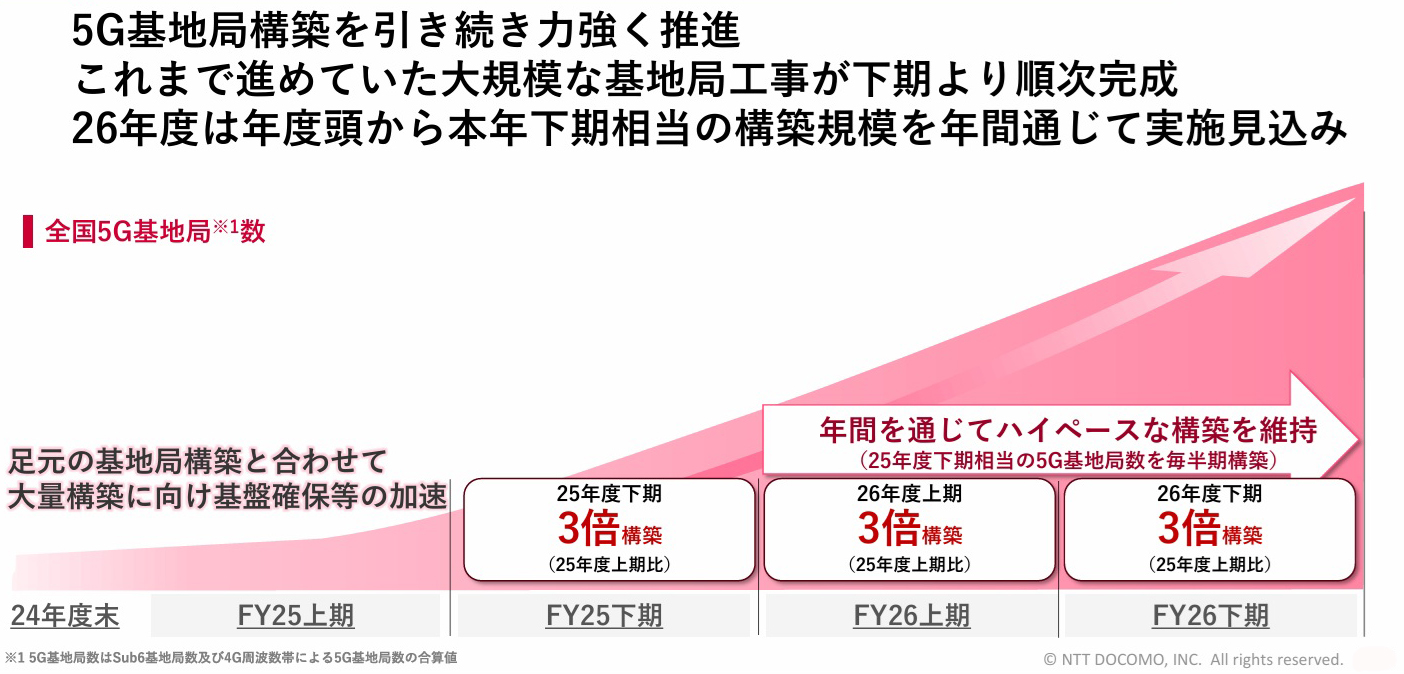

To strengthen the network, the company is focusing on capital investment, accelerating the construction of base stations and the replacement of existing equipment with the latest technology.

“Download throughput is steadily improving in the centers of major cities, and the areas where service is comfortable are expanding,” said President Maeda.

In the second half of this fiscal year, the company is building three times as many base stations as in the first half, and is currently progressing according to plan.

The company plans to maintain this momentum in fiscal 2026. Through these measures, the company will have the same number of base stations as its competitors by fiscal 2026.

President Maeda said, “We are building primarily Sub6. While communication quality is not determined solely by the number of base stations, we believe that by fiscal 2026 we will be able to achieve quality that is comparable to, or even better than, that of other companies.”

Currently, the company is working on both accelerating the strengthening of its network and structural reform. The company has been working hard to cover the costs required to achieve this structural transformation by all possible means, including cost efficiency improvements and asset utilization, but has determined that it will be difficult to absorb them all within this fiscal year’s profit plan. Therefore, the company has revised its earnings forecast.

While operating revenue remains at ¥6.336 trillion, the company has revised its operating profit forecast downward to ¥883 billion, down ¥83 billion from the initial ¥966 billion forecast.

The company cited intensifying and prolonged MNP competition as the primary reason for the revision. The competitive environment remains stronger than expected, and sales promotion costs are expected to increase by more than ¥113 billion compared to the initial estimate.

Another factor cited was the higher-than-expected device returns in the “Itsudemo Kaedoki Program.” This program allows users to purchase expensive, cutting-edge smartphones at roughly half price through 24 installments with a residual value, provided the device is returned in approximately two years (the 23rd month). The more devices are returned, the less revenue the company receives.

NTT DATA Group’s Data Center Business Expands

NTT DATA Group’s April-December 2025 financial results show increases in both revenue and profit. Operating revenue was 3.6438 trillion yen (an increase of 236 billion yen year-on-year), and operating profit was 384.2 billion yen (an increase of 148.2 billion yen year-on-year).

The gain on the transfer of a data center in the second quarter also contributed to the increase in revenue and profit. The gain on the transfer of the data center was planned to be 155.4 billion yen, but the actual figure was 129.5 billion yen, a decrease of 26 billion yen. As a result, the equivalent of the decrease has been reflected in the full-year earnings forecast.

Full-year operating revenue was 4.9107 trillion yen, a decrease of 26 billion yen from the initial forecast. Operating profit was also reduced by 26 billion yen to 496 billion yen.

In the Japan segment, operating revenue increased in all areas. Overall segment revenue increased by 77.1 billion yen. In the Overseas segment, revenue decreased in APAC, but the gain on the transfer of the data center and the steady expansion of the data center business led to an increase in overall Overseas segment revenue of 180 billion yen.

In the Japan segment, operating profit decreased in the Public & Social Infrastructure segment, but increased in the Financial & Corporate segments, resulting in an overall segment profit increase of 4.6 billion yen. In the Overseas segment, increased profits due to higher sales and cost controls resulted in an overall segment profit increase of 158.3 billion yen.

In North America, orders decreased compared to the previous period due to a backlash from last year’s large projects, but the development of large projects already received led to increased sales and profits excluding the impact of foreign exchange rates.

Meanwhile, Germany continues to struggle from last year. Latin America and Spain are performing well, and the UK is also showing signs of recovery. Overall, EMEAL saw increased sales and profits.

In APAC, sales of telecommunications equipment and communications terminal equipment were sluggish, but the cloud & security business was growing, resulting in an increase in sales and profits excluding the impact of foreign exchange rates. Global Technology & Solution Services (GTSS) saw increased sales and profits due to the effect of gains on the transfer of data centers and one-off income such as incentives associated with data center sales. Overall, the segment is on a recovery trend.

As of the third quarter, the company has invested US$1,687 million in data centers. New services have been launched in Thailand and India. Construction of a data center in Kyoto has also been completed. Revenues are also expanding steadily.

※Translating Japanese articles into English with AI